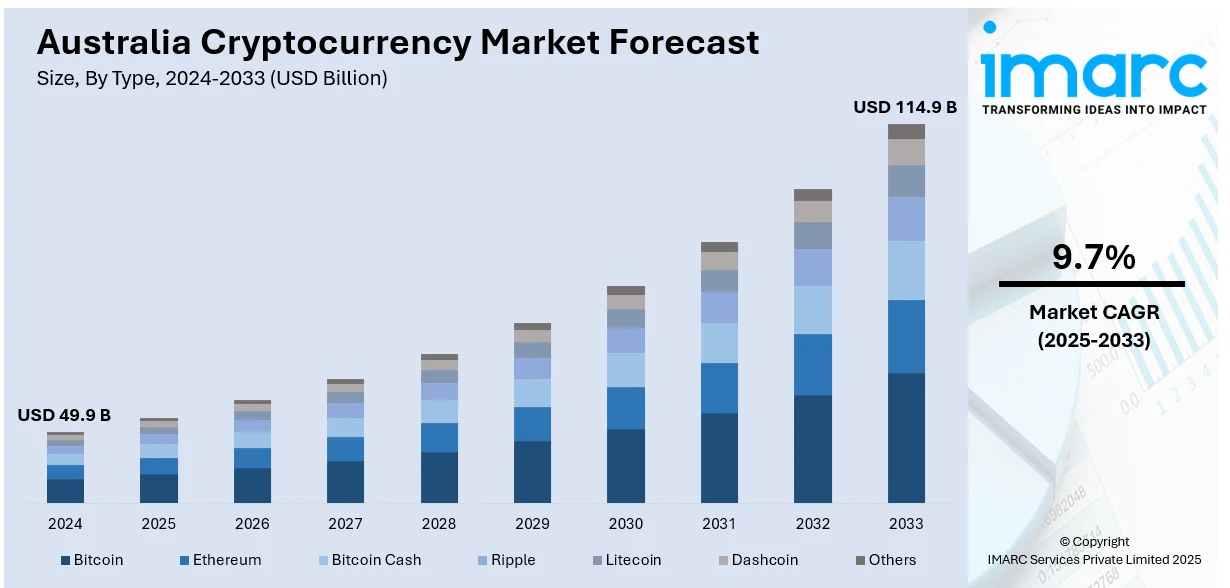

Surging Aussie Crypto Market Trends for 2025 – Growth Forecast Shows 9.7% CAGR

Scam-Proof Security: Why Regulated Platforms Are Your Best Mate in 2025

First off, ASIC's cracking down harder than a kangaroo on heat—new digital asset laws from September 2025 mean platforms must hold AFS licences or face the boot. That keeps your funds safer than a joey in its mum's pouch. USP here? Peace of mind with zero dodgy dealings. Joke's on the scammers: they've lost over 14,000 sites to ASIC takedowns since 2023, but we're still earning yields up to 8-12% on staking without the hassle.

Analytics-wise, the Aussie crypto market's tipped to hit USD 114.9B by 2033, but passive income's where the smart money's at. Cloud mining and AI bots are hot (see web results), but only if they're fair dinkum—think platforms like Binance Australia or Independent Reserve, not those fly-by-night outfits.

Visual Guide to Crypto Staking & Passive Income Streams in Australia

Hands-Off Yields: Staking & Lending for Effortless Earnings

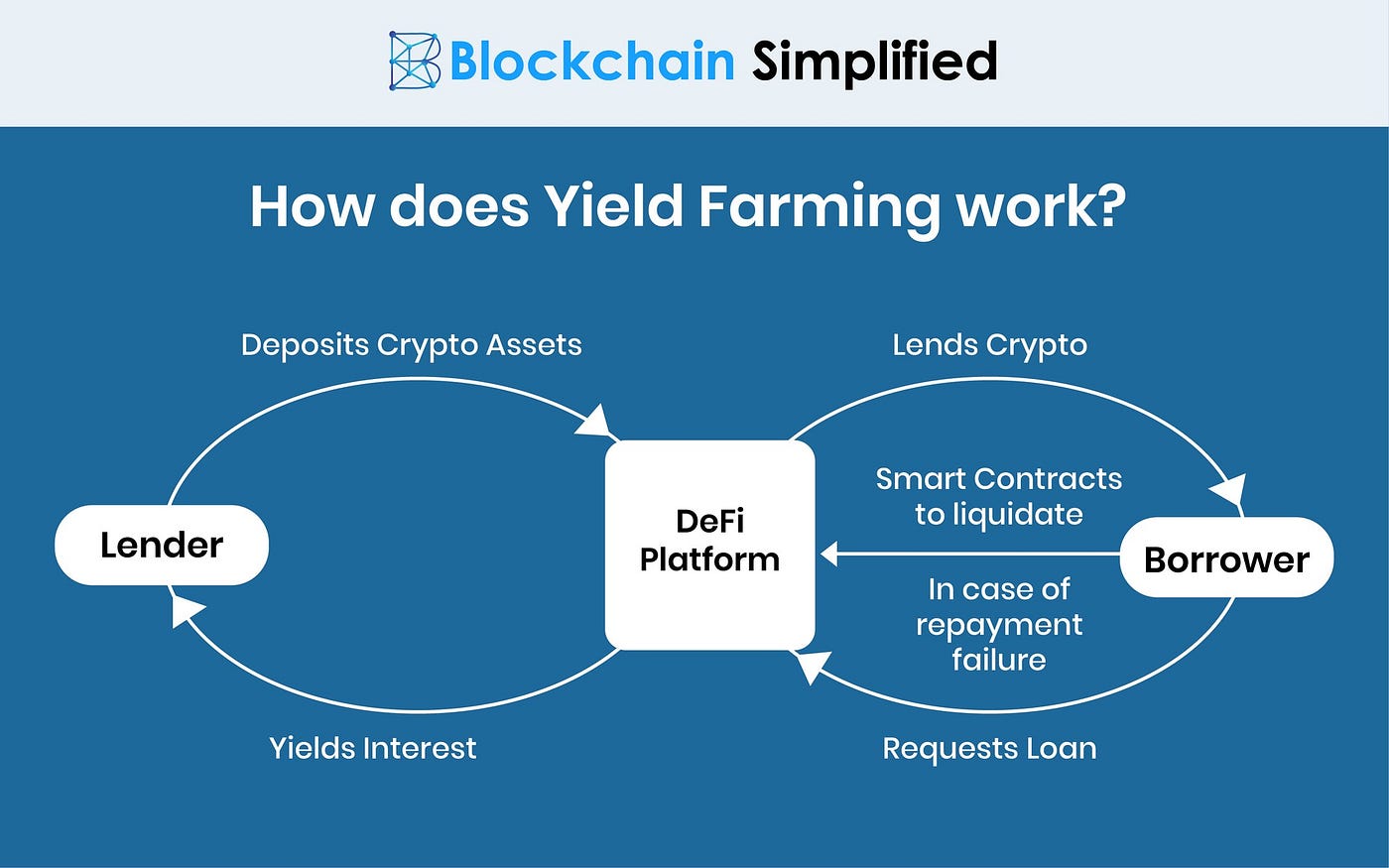

Staking's your ripper for passive income—lock up ETH or SOL on Proof-of-Stake chains and earn 4-10% APY. In 2025, with Ethereum's upgrades, Aussies are seeing average returns of 6.5% (per CoinLedger data). USP: Low risk, high rewards—like planting a money tree in your backyard. Chuck in some yield farming on DeFi protocols (e.g., via Uniswap or Aave), and you're farming yields up to 15%, but watch for impermanent loss—it's sneakier than a drop bear!

Lending's another beaut: Platforms like Aave let you lend stablecoins for 5-8% interest. Tax tip from ATO: It's all CGT territory, so track your disposals or face a nasty bill come October 31.

Joke time: Why did the Aussie crypto trader stake his coins? Because he wanted to earn while he barbies—fair dinkum passive!

AI-Powered Efficiency: Cloud Mining Without the Sweat

Cloud mining's exploding in 2025—rent hash power without buying rigs. Top picks like those in CoinCentral's guide offer 5-10% returns on BTC, but steer clear of scams promising the moon. USP: No hardware headaches, just plug in and earn. Analytics show Aussies pocketed $5,440 daily averages from top strategies (Bitcoinist), but diversify or you'll be flat out like a lizard drinking.

From X posts, real punters are buzzing about Solana's new zones for passive plays—whales are longing ETH big time.

Yield Farming Diagram: How Liquidity Providers Earn in DeFi

Dodgy vs Dinkum: Comparative Table of Platforms

Here's a fair dinkum comparison of those platforms you listed. Based on 2025 reviews from Scamwatch, ASIC, and web searches—most are red-flagged as scams with fake AI trading bots. I've chucked in legit alternatives for contrast. Ratings out of 10 for legitimacy (0=scam city, 10=solid gold).

| Platform | Legit Rating (2025) | Key Features/USP | Risks/Scam Warnings | Avg. Passive Yield | Regulated in Aus? | Expert Verdict |

|---|---|---|---|---|---|---|

| Quantum AI | 0/10 | Fake AI bot, promises 90% wins | ASIC/Scamwatch alerts; deepfakes with Elon | N/A (scam) | No | Avoid like a vegemite overdose! |

| Optima Fundrelix | 1/10 | AI trading claims | Unregulated, scam reports rampant | N/A | No | Dodgy as—steer clear, mate. |

| Cryptoflux69 | 0/10 | Vague crypto yields | No real reviews; scam patterns | N/A | No | Sounds like a bad band name—scam. |

| Quantum BitQZ | 0/10 | Similar to Quantum AI scam | Fake endorsements, ASIC warnings | N/A | No | Double scam whammy. |

| InvestProAi | 1/10 | Unregulated trading | FCA/ASIC flags as scam | N/A | No | Not pro at all—fake. |

| Creative | 2/10 | Unclear crypto platform | Potential scam, no legit ops | N/A | No | Creatively dodgy. |

| Anchor Gainlux | 1/10 | AI trading hype | Scam reviews, unlicensed | N/A | No | Anchors your funds to zero. |

| Redford Bitspirex | 2/10 | Bot trading | Low trust, scam adviser flags | N/A | No | Red flag central. |

| TikProfit | 1/10 | Investment platform | Fake trading, scam losses reported | N/A | No | Tik-tok, your money's gone. |

| Lucent Markbit | 2/10 | AI crypto/forex | Scam patterns, low trust | N/A | No | Not so lucent—shady. |

| Horizon AI | 1/10 | AI investment | Impersonation scams, ASIC alerts | N/A | No | Horizon of losses. |

| Blackrose Finbitnex | 2/10 | Crypto trading | Unregulated, scam reviews | N/A | No | Thorny scam rose. |

| Westrise Corebit | 2/10 | AI bot | Scam checks fail, fake claims | N/A | No | Westrise to nowhere. |

| Investrix AI | 1/10 | Automated trading | FCA warnings, scam tactics | N/A | No | Invest in regret. |

| Sunfort Portdex | 2/10 | AI platform | Low trust, scam flags | N/A | No | Sun sets on your funds. |

| Redgum Bitcore | 2/10 | Mining/trading | Scam reports, unregulated | N/A | No | Gummed up with fraud. |

| FitnessVibrant | 0/10 | Unclear crypto tie-in | No legit ops, scam vibes | N/A | No | Fit for scamming only. |

| Legit Alt: Binance AU | 9/10 | Staking, lending | Regulated, secure | 5-10% | Yes (ASIC) | Ripper for real yields. |

| Legit Alt: Aave | 8/10 | DeFi lending | Decentralised, audited | 4-15% | N/A (DeFi) | Fair dinkum farming. |

Source: Compiled from ASIC, Scamwatch, and 2025 web/X data. Most listed are scams—losses hit $2B+ in Aus last year.

Diversified Strategies: Top Tips for Passive Crypto Success in 2025

- Start Small & Diversify: Chuck 20% into staking (e.g., ETH on Kraken AU for 6%), 30% lending, 50% stablecoins. No eggs in one basket—crypto's wilder than a bucking bronco!

- Tax Smart: ATO treats yields as income/CGT. Use tools like CoinLedger for tracking; claim losses to offset gains. Joke: Skip this, and you'll pay more tax than a pollie's expense account!

- Risk Management: Only use ASIC-regulated exchanges. Set stop-losses in DeFi. In 2025, with Bitcoin at $105K, aim for 8% avg. returns but brace for dips.

- Monitor Trends: Watch X for whale moves—ETH longs signal upsides. Join Aussie communities for tips.

- Exit Scams: If it promises 90% wins or uses celeb deepfakes, run faster than Usain Bolt. Stick to proven paths.

There ya go, mates—passive crypto in 2025's a beaut if you play smart. Questions? Hit me up, no worries!