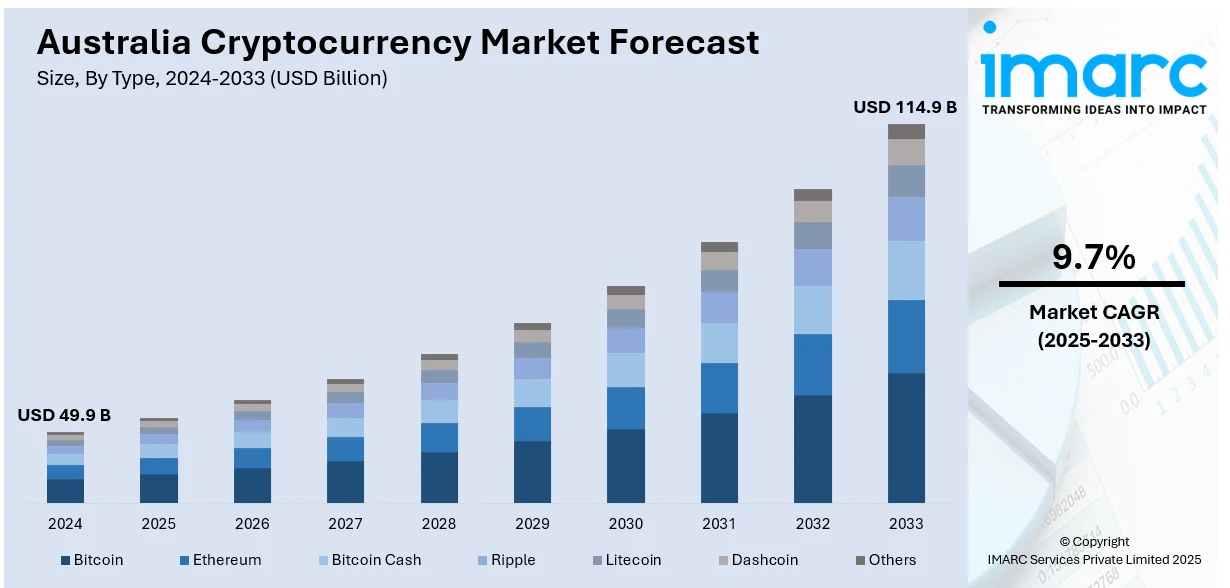

Australian crypto market trends 2025 chart

No Hard Yakka: Why Passive Crypto Rules in 2025

Passive income? It's like finding a vegemite sandwich that pays you to eat it—effortless and rewarding. In Australia, with stricter regs from AUSTRAC keeping things fair dinkum, we're seeing more blokes and sheilas dipping into staking, lending, and yield farming. No need to stare at charts all day; let the bots and protocols do the heavy lifting. Just remember, crypto's volatile—don't bet the farm, or you'll end up skint like a kangaroo in a drought.

Unique Selling Point: Regulated Platforms for Safe Wins

Forget the shady operators; stick to ASIC-approved exchanges. Platforms like Binance Australia and Kraken offer staking yields up to 10% on ETH in 2025, with low fees and insurance against hacks. It's like having a guard dog for your digital wallet—peace of mind while your coins multiply.

Ripper Analytics: What's Hot in Aussie Crypto

In 2025, Bitcoin's still king, but Ethereum's layer-2s are stealing the show for passive plays. Stablecoins like USDT are yielding 5-8% via lending on Aave, backed by real-world assets. Adoption's jumped from 17% in 2019 to 31% now—more Aussies own crypto than ever. But watch for volatility; Trump's trade wars could shake things up, though gold's surge shows safe havens are in vogue.

Passive income crypto strategies infographic

Fair Dinkum Warnings: Dodgy Platforms to Dodge

Now, about those listed platforms—Quantum AI, Optima Fundrelix, and the rest? Crikey, most scream scam louder than a cockatoo at dawn. Reviews from Trustpilot and ScamAdviser show low trust scores, complaints of lost funds, and red flags like anonymous teams and impossible returns. Quantum AI's got folks crying foul over withheld withdrawals, while Blackrose Finbitnex reeks of pyramid vibes. No worries, though—I've got the real deal in the table below. Joke's on the scammers; they're as useful as a chocolate teapot.

Comparative Table: Legit vs. Listed (With a Chuckle)

| Platform | Type | Avg. Yield (2025) | Fees | Trust Score | Why It's a Ripper (or Not) |

|---|---|---|---|---|---|

| Binance Australia | Staking/Lending | 5-12% | Low (0.1%) | High (Regulated) | Fair dinkum for Aussies—stake ETH, earn while sleeping. No scam vibes here, mate. |

| Kraken | Staking | 4-10% | Minimal | High | Solid as Uluru; great for BTC holdings. Beats the dodgy ones hands down. |

| Coinbase | Earn Rewards | 3-8% | Moderate | High | Easy app, but watch the fees—better than losing your shirt to a scam. |

| Quantum AI* | AI Bot | Claimed 85% win rate | Hidden | Low (Scam alerts) | Dodgy as—reviews scream fraud. Avoid like a drop bear. |

| Optima Fundrelix* | Trading Bot | Variable (suspect) | High | Very Low | Red flags everywhere; more complaints than a whinging pom. |

| Cryptoflux69* | Bot | Unverified | Unknown | Scam | Sounds fake, is fake. Chuck it in the bin. |

| Horizon AI* | AI Platform | Claimed high | Hidden | Low | Hype over substance; potential rug pull. |

| Others (e.g., Blackrose Finbitnex)* | Bots | Inflated claims | High | Scam | All bark, no bite—stay clear, legends. |

*Warning: These look like scams based on 2025 reviews. Stick to regulated ones or you'll be flat out broke.

Australian dollars and bitcoin illustration

Strategy Tips: Build Your Crypto Empire Like a Boss

- Diversify, Mate: Don't chuck all your eggs in one basket. Mix staking (e.g., 50% ETH on Kraken) with lending (USDT on Aave for steady 6%). In 2025, aim for 40% BTC, 30% altcoins, 30% stables.

- Risk Management 101: Set stop-losses and only invest what you can afford to lose. Use tools like yield calculators—expect 5-15% APY, but factor in volatility. Joke: Crypto's like surfing; ride the wave, but watch for sharks.

- Tax Smarts: ATO's watching—report staking rewards as income. Use platforms with auto-reports to avoid a headache come tax time.

- Start Small: Begin with $250 on a demo account. Scale up as you learn. In Oz, leverage AUSTRAC regs for safety.

- Stay Sharp: Follow trends like AI bots (legit ones) and RWA yields. But remember, if it promises the moon, it's probably cheese.

There you have it, cobbers—passive crypto income in 2025 ain't rocket science, but skip the scams or you'll be up the creek without a paddle. Chuck me a message if you've got questions; let's make some dosh! No worries, stay safe out there.