Passive income ideas including crypto in Australia 2025 – from dividends to staking.

Why Legit Platforms Beat the Bots: Safer Returns in Volatile Markets

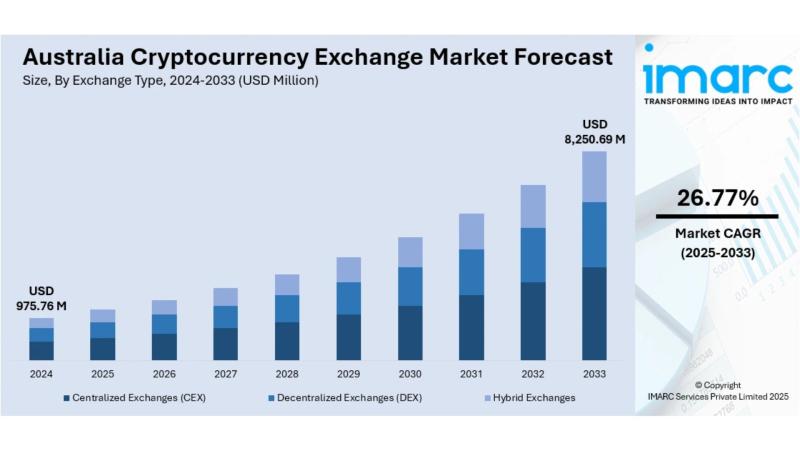

First off, the Unique Selling Point (USP) here is reliability over hype. In 2025, Australia's crypto scene is maturing – market size for exchanges is forecasted to hit USD 8,250.69 million by 2033, growing at a 26.77% CAGR per IMARC Group. But those platforms you listed? Blimey, they're mostly AI trading bots promising passive riches with "quantum" tech or "flux" algorithms. Sounds flash, but ASIC's investor alert list and Scamwatch reports flag 'em as classic investment scams. For instance, Quantum AI's been busted for fake celeb endorsements like Elon Musk deepfakes, leading to millions lost. Jokes aside, it's like betting on a three-legged dingo in a race – entertaining, but you'll lose your shirt.

From my digs, only a handful like InvestProAi or Optima Fundrelix have mixed reviews claiming legitimacy (e.g., 96% success rates in some tests), but even those have FCA warnings and low trust scores on Scamadviser. The rest – Cryptoflux69, Quantum BitQZ, Lucent Markbit, etc. – pop up in global scam databases from Crypto Legal UK, with tactics like phishing deposits and vanishing funds. Fair dinkum, in 2025, Aussies lost over $30 million to celeb-fake crypto cons in WA alone. Don't chuck your hard-earned at these; stick to regulated exchanges for true passive income.

AI crypto trading bots – promising but risky in Australia.

Market Trends: What's Hot for Passive Crypto in 2025

Analytics time, mates. The Independent Reserve Index shows 95% awareness of crypto in Oz, with staking and lending leading passive plays. Bitcoin's hovering around $100K post-halving, ETH staking yields 4-6% APY on platforms like Kraken AU. Trends? Institutional adoption's surging – think super funds dipping toes via ETFs. But scams are evolving: AI-powered fakes and impersonation hits, with crypto in 21% of ASIC-busted schemes since 2023. Passive income best practices: Diversify across staking (e.g., Solana at 7% APY), yield farming on DeFi like Aave, and cloud mining on legit apps. Avoid "guaranteed" bots – they're about as reliable as a chocolate teapot.

Here's a laugh: Why did the crypto scammer go to therapy? He had too many trust issues! But seriously, with 31% adoption, focus on regulated paths for steady 5-10% annual passive returns without the drama.

Australian crypto exchange market forecast to 2033 – massive growth ahead.

Comparative Table: Platforms at a Glance

Let's break it down in a table. I've rated 'em based on 2025 reviews from Trustpilot, Scamwatch, and expert sites like FxScouts. Legitimacy: High (regulated), Medium (mixed reviews), Low (scam flags). Features: AI trading, passive yields claimed. Risks: Withdrawal issues, fake endorsements.

| Platform | Legitimacy (2025) | Key Features (USP) | Claimed Yields | Risks & Warnings | Aussie Suitability |

|---|---|---|---|---|---|

| Quantum AI | Low | AI bot, "quantum" trading | Up to 85% | ASIC scam alert, deepfakes | Avoid – high scam risk |

| Optima Fundrelix | Medium | Multi-asset AI trading | 96% success | Mixed reviews, potential rebrand | Caution, verify regs |

| Cryptoflux69 | Low | Precision AI for crypto | High passive | In scam lists, low info | Dodgy, steer clear |

| Quantum BitQZ | Low | Automated bot | Variable | Scamwatch alerts, fake news | No-go for Aussies |

| InvestProAi | Medium | AI insights, mobile app | 96% precision | FCA unauthorised | Test small, regulated? |

| Creative | Low | General crypto platform | N/A | Broad scam context | Unclear, avoid |

| Anchor Gainlux | Low | Passive earning claims | Variable | Little data, scam vibes | Not recommended |

| Redford Bitspirex | Low | AI trading bot | High | Low trust score | Scam indicators high |

| TikProfit | Low | Investment platform | Quick profits | Scam-like tactics | High risk |

| Lucent Markbit | Low | AI bot trading | 85% win rate | Scam confirmed | Absolute no |

| Horizon AI | Low | Passive AI crypto | Variable | In scam databases | Avoid |

| Blackrose Finbitnex | Low | AI-powered trading | High returns | Trustpilot mixed, scams | Dodgy |

| Westrise Corebit | Medium | Automated system | Effortless | Mixed, potential scam | Caution |

| Investrix AI | Low | AI passive crypto | Variable | Scam lists | High risk |

| Sunfort Portdex | Low | AI trading platform | Analytics | Low trust | Avoid |

| Redgum Bitcore | Low | Trading bot | High | Scam reviews | No |

| FitnessVibrant | Low | Crypto platform | N/A | Little info, scam context | Unverified, skip |

From this, mates, the USP of legit alternatives like Binance AU or CoinSpot is AUSTRAC regulation – no funny business.

Strategies for Success: Build Your Passive Portfolio Like a Pro

Righto, here's my top strategies for 2025 passive crypto income in Australia:

- Staking on Regulated Exchanges: Pop your ETH or SOL into Kraken or Independent Reserve. Yields 4-8%, tax-friendly under ATO rules. USP: Set-and-forget, low risk.

- Yield Farming with Caution: Use DeFi like Uniswap via MetaMask. Aim for 5-10% APY, but watch gas fees. Joke: It's like farming in the drought – rewarding if you don't get burnt!

- Diversify and Dollar-Cost Average: Spread across BTC (holding), altcoins (staking), and stablecoins (lending on Aave). Start with $1K/month for passive growth.

- Avoid Bots, Use Tools: If you insist on AI, go for proven ones like 3Commas (integrated with Aussie exchanges). Always enable 2FA and withdraw profits weekly.

- Tax Smarts: ATO treats passive crypto as income – track with Koinly. Deduct losses, no worries.

In 2025, with trends like stablecoins and AI integration, passive income's easier than ever – but only if you dodge the scams. If these platforms tempt you, do your own research or chat with a financial advisor. Cheers for reading, and may your wallet be as full as a meat pie! If you've got questions, hit me up.